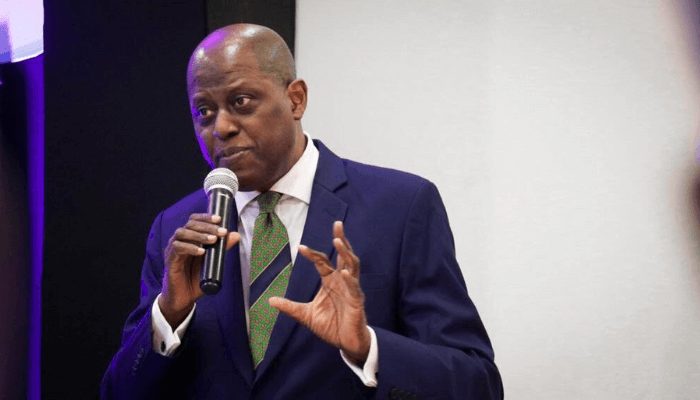

Dr. Olayemi Cardoso, the Governor of the Central Bank of Nigeria (CBN), disclosed that a significant portion of the $7 billion foreign exchange backlog inherited by his administration consisted of questionable transactions.

During an interview on Arise TV on Monday, Cardoso shed light on the challenges faced in addressing the backlog and the findings of a forensic audit conducted to assess the validity of these obligations.

Cardoso explained that upon assuming office, the CBN began the process of settling outstanding obligations, prioritizing those deemed valid and legitimate. However, as they delved deeper into the backlog, concerns arose regarding the authenticity of some transactions.

To gain clarity, the CBN engaged Deloitte management consultants to conduct a forensic audit of the obligations.

The results of the audit were startling, revealing that approximately $2.4 billion of the $7 billion backlog was associated with various infractions. These infractions ranged from the absence of valid import documents to the involvement of non-existent entities. In some instances, account holders received foreign exchange allocations exceeding their requests, while others received allocations despite not making any requests at all.

In response to these findings, Cardoso affirmed that the CBN would not honor transactions that did not meet the necessary criteria. He emphasized the importance of maintaining integrity and transparency in the allocation of foreign exchange, stating that only valid transactions would be considered for payment.

The revelation of the substantial portion of the forex backlog attributed to non-existent entities and other infractions underscores the challenges faced by the CBN in managing the currency market. Moving forward, the CBN is committed to addressing these issues and ensuring that foreign exchange allocations are allocated equitably and in accordance with established guidelines.